Introduction:

The AUD/NZD forex pair has experienced significant volatility recently, with interest rate divergences and macroeconomic factors influencing the outlook. In this AUD/NZD forecast March 2025 , we examine key elements that could affect AUD to NZD movements, including central bank policies, economic data, and global trade influences. Forex traders should stay updated on these factors to make informed decisions in this dynamic market.

Why Is the AUD/NZD Forex Pair Important for Traders?

The AUD/NZD currency pair is one of the most traded currency pairs in the Forex market. It is driven by economic fundamentals in Australia and New Zealand, including interest rates, inflation, and GDP growth, as well as global factors such as commodity prices and geopolitical developments. Understanding these drivers is crucial for successful trading strategies.

Fundamental Analysis: Key Drivers for AUD/NZD

1. Interest Rate Divergence: Australia vs. New Zealand

- Australia (RBA’s Rate Hold): The Reserve Bank of Australia (RBA) has kept rates at 4.10%, holding steady while inflation shows signs of stability at 2.5%. The RBA’s cautious approach suggests it may hold rates steady until inflation aligns more closely with its target. This stance supports a bullish outlook for the Australian Dollar (AUD) in the near term, particularly as the interest rate differential between Australia and New Zealand remains favorable.

- New Zealand (RBNZ’s Rate Cuts): On the other hand, the Reserve Bank of New Zealand (RBNZ) has been aggressively cutting rates to stimulate growth, with the official cash rate at 3.75% as of February 2025. The RBNZ’s policy is in response to slow GDP growth and rising unemployment. Lower rates typically make the New Zealand Dollar (NZD) less attractive, putting downward pressure on the NZD relative to the AUD.

2. Economic Data: Inflation, GDP Growth & Unemployment

- Australia’s Stable Inflation & Employment: Australia’s inflation rate has stabilized at 2.5%, while the unemployment rate remains low at 4.1%. These figures suggest a stable economic environment, which should support demand for the AUD in the medium term.

- New Zealand’s Slower Growth: New Zealand’s GDP growth has slowed, with a contraction of 1.1% in Q4 2024, while unemployment rose to 5.1%. This weaker economic outlook, combined with the RBNZ’s rate cuts, is expected to continue exerting downward pressure on the NZD.

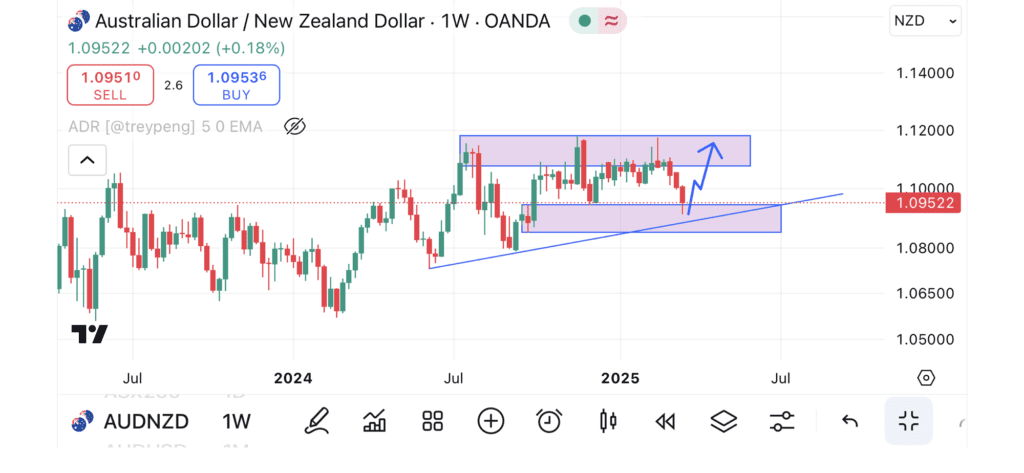

Technical Analysis: AUD/NZD Price Action and Key Levels

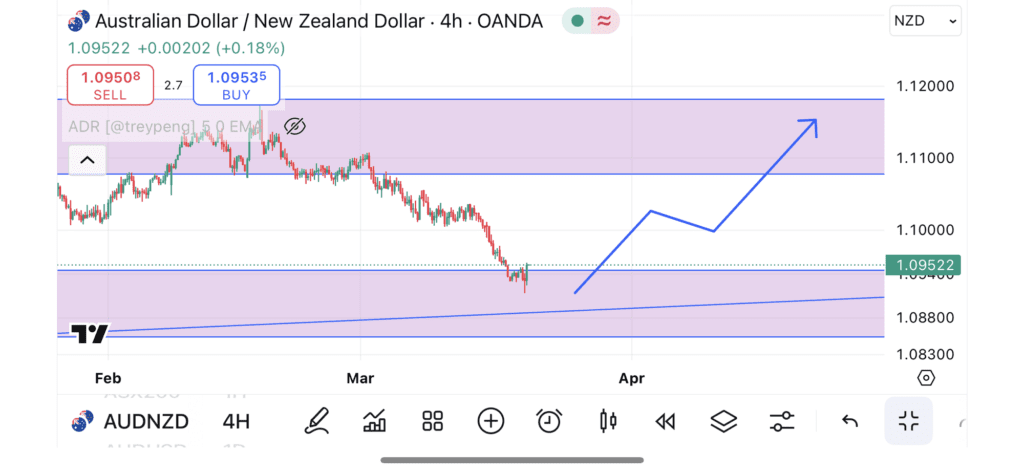

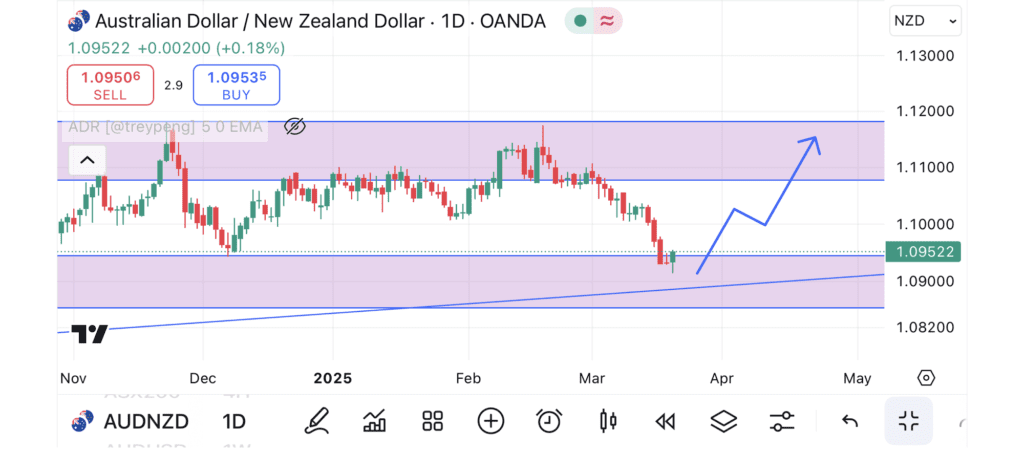

Current Market Overview (March 18, 2025)

- Price Level: 1.09531

- Support Zone: 1.0900 – 1.0950 (Strong demand area for AUD)

- Resistance Zone: 1.1100 – 1.1150 (Major resistance zone)

The AUD/NZD pair is currently near key support levels at 1.0900 – 1.0950, which could provide a strong foundation for a potential price recovery. Traders should monitor the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) indicators for signals of a potential rebound from these support levels.

Commitments of Traders (COT) Report: Speculator Sentiment AUD/NZD forecast March 2025

- AUD Positioning: Non-commercial traders are net-short on the AUD, reflecting a bearish outlook among speculators. However, commercial traders remain net-long on the AUD, indicating that hedgers are positioning for potential recovery in the Australian economy.

- NZD Positioning: Similarly, speculators hold net-short positions on the NZD due to the RBNZ’s dovish policies and weak economic performance. Commercial traders’ net-long positions suggest optimism about a possible recovery, but the NZD is likely to remain under pressure in the near term.

Trade Strategy for AUD/NZD: Opportunities in the Market

1. Buy on Dips (Near-Term Outlook):

Given the ongoing interest rate divergence, buying on pullbacks near 1.0900 – 1.0950 offers a low-risk entry point for traders expecting a recovery in the AUD. If the pair holds above this support zone, the next resistance target would be around 1.1100 – 1.1150.

2. Monitor Breakouts (Medium-Term Outlook):

For medium-term trades, monitor a potential break above 1.1100. If the pair surges past this level, it could signal further upside momentum toward 1.1150 and higher levels. Pay close attention to any global economic data or central bank decisions that could impact the overall risk sentiment.

3. Use Stop-Loss area to Manage Risk:

As with any Forex trade, it’s crucial to use stop-loss area to protect against unexpected volatility. A reasonable stop-loss could be placed just below the 1.0900 level, ensuring that traders manage their risk effectively if the support level breaks.

Why Forex Traders Should Care About the AUD/NZD Pair

- Interest Rate Differentials: The ongoing interest rate divergence between the RBA and RBNZ makes the AUD/NZD pair highly attractive for traders looking to capitalize on the economic disparity between the two countries.

- Global Trade Dynamics: As global commodity prices fluctuate and economic conditions evolve, both the AUD and NZD are sensitive to changes in global risk sentiment, making them ideal candidates for short-term trading strategies.

Conclusion: Is a Buy in AUD/NZD forecast March 2025?

AUD/NZD is poised for a near-term recovery, driven by rate divergence, stable Australian economic indicators, and ongoing economic challenges in New Zealand. Forex traders should consider taking positions around 1.0900 – 1.0950 support levels, with potential upside targets at 1.1100 – 1.1150. Monitor the interest rate policies, inflation data, and global trade conditions closely for further clues.

Stay ahead of the market by subscribing to our Forex newsletter for the latest updates, forecasts, and trading strategies. Join a community of Forex traders and gain access to expert insights on the AUD/NZD currency pair and more.